HWATAI has been reorganized into a commercial bank at the approval of competent authorities pursuant to the Standards and Regulations for The Reorganization of Credit Unions into Commercial Banks. The following are the major events of the predecessor of this bank, the Taipei Second Credit Union and the details of its reorganization into a commercial bank, which cover a period of 80 years:

- 1933 Taipei Chyuan Yeh Credit Association

The first shareholders meeting was convened and the formation of the board. The election of directors and supervisors was held. Mr. Chen Ching-Po was elected as the President and Mr. Wang Jin-Tung was elected as the supervisor. Officially opened for business at No. 9, Di Hwa Street Section 1, Taipei.

- 1946 Limited Liability Taipei Chyuan Yeh Credit Cooperative

After Taiwan recovered from Japanese rule, the credit union organization underwent reorganization in accordance with the Credit Union Law. Mr. Chen Wei-Cheng was elected the first chairman and the name of the credit union was changed also.

- 1947 Limited Liability Taipei Second Credit Cooperative

The credit union was renamed under an executive order issued by the Committee on the Management of Cooperation under the Civil Affairs Department, Taiwan Administrative Office.

- 1966 Taipei Second Credit Cooperative

The credit union was renamed under a resolution by the meeting of the management.

- 1999 HWATAI Bank

The credit union was reorganized at the approval of competent authorities and was licensed as HWATAI and held the same title in business registration on Jan 1, 1999. The original registration of Taipei Second Credit Union was revoked simultaneously.

- 2001

The first special shareholder meeting was held for year 2001 on Dec 28. Election for the second board of directors and supervisors was held. Mr. Lin Ming-Hsiung was elected the chairman of the board of directors. Mr. Liu Hsin-Jen was elected the standing supervisor of the board of supervisors.

- 2003

On July 21, set up International Banking Department for foreign currency business and Trust Department for trust business-savings trust, ancillary business-consigned bond issuance, value securities certification, custodian business and consigned securities investing in trust funds.

- 2004

Build up Security Trading Department and Retail Banking Department.

- 2005

Set up Offshore Banking Unit and Wealth Management Department.

Company charter revised and Corporate Banking, Retail Banking, and General Administration divisions established to strengthen competitiveness.

- 2006

Charter revision approved by Shareholders’ Meeting to raise the Bank’s capital to NT$8 billion; no shares issued, but board of directors authorized to issue shares in tranches as required by business needs.

- 2007

The Bank’s investment in establishment of the Hwatai bank Insurance Brokers Co. approved by the Former Financial Supervisory Commission.

Min-Hsiung Lin resigned chairmanship because of The Former Financial Supervisory Commission’s interpretation that the chairman, president, and or person of other equivalent rank of a bank may not serve as chairman, president, or person of other equivalent rank in a nonfinancial enterprise. On that same day, an extraordinary meeting of the Board of Standing Directors approved the selection of vice chairman Po-Yi Lin as the new chairman.

- 2009

Organization restructured; Small Business Department and Securities Investment Department removed from Corporate Banking Division, business of the Securities Investment Department merged into the Treasury Department, and Overdue Loan Management Department and Treasury Department repositioned as independent management units. Regional Centers and Consumer Financing Department removed from the Retail Banking Division; Consumer Financing Department merged into the Consumer Banking Strategy Department and renamed Consumer Marketing Department; Consumer Credit Management Department renamed Consumer Credit Department. The Secretariat Department was removed from the General Administration Division and its tasks merged into the General Affairs Department. Nanking E.Rd. Branch upgraded to a full-function branch under the Corporate Banking Division.

- 2010

Organizational readjustment. The Zhongli, Taichung, Kaohsiung, branches (integrated corporate and retail banking, and teller operations) put under the Corporate Banking Division on the full-function model.

The Bank inaugurated a new financial product for Taiwan:“Prepaid interest 13- and 15-month fixed-interest, fixed-term deposits.”

The Bank won the Taipei City Outstanding Healthy Workplace award (the only non-financial holding bank to be so honored) as well as Outstanding Breastfeeding Room label from the Taipei City Department of Health.

- 2012

To downsize the bank-wide organization and strengthen competitiveness, the Bank’s organization was readjusted with the removal of the Corporate Banking, Retail Banking and Administrative Management Department, while Executive vice presidential / vice presidential positions were added.

The Tong Hu Branch began operating as a full-function branch under the Corporate Marketing Department.

- 2013

The Tun Hwa, Ban Qiao, Hsin Chuang, Xin Dian, and Chein Cheng branches began operating as full-function branches under the Corporate Marketing Department, and the Kwang Fu Branch began operating as a full-function branch under the Comsumer Marketing Department.

The Nan Men and Wen Shan branches were reorganized into mini-branches, and the Chein Cheng and San Chong branches were reorganized into general branches.

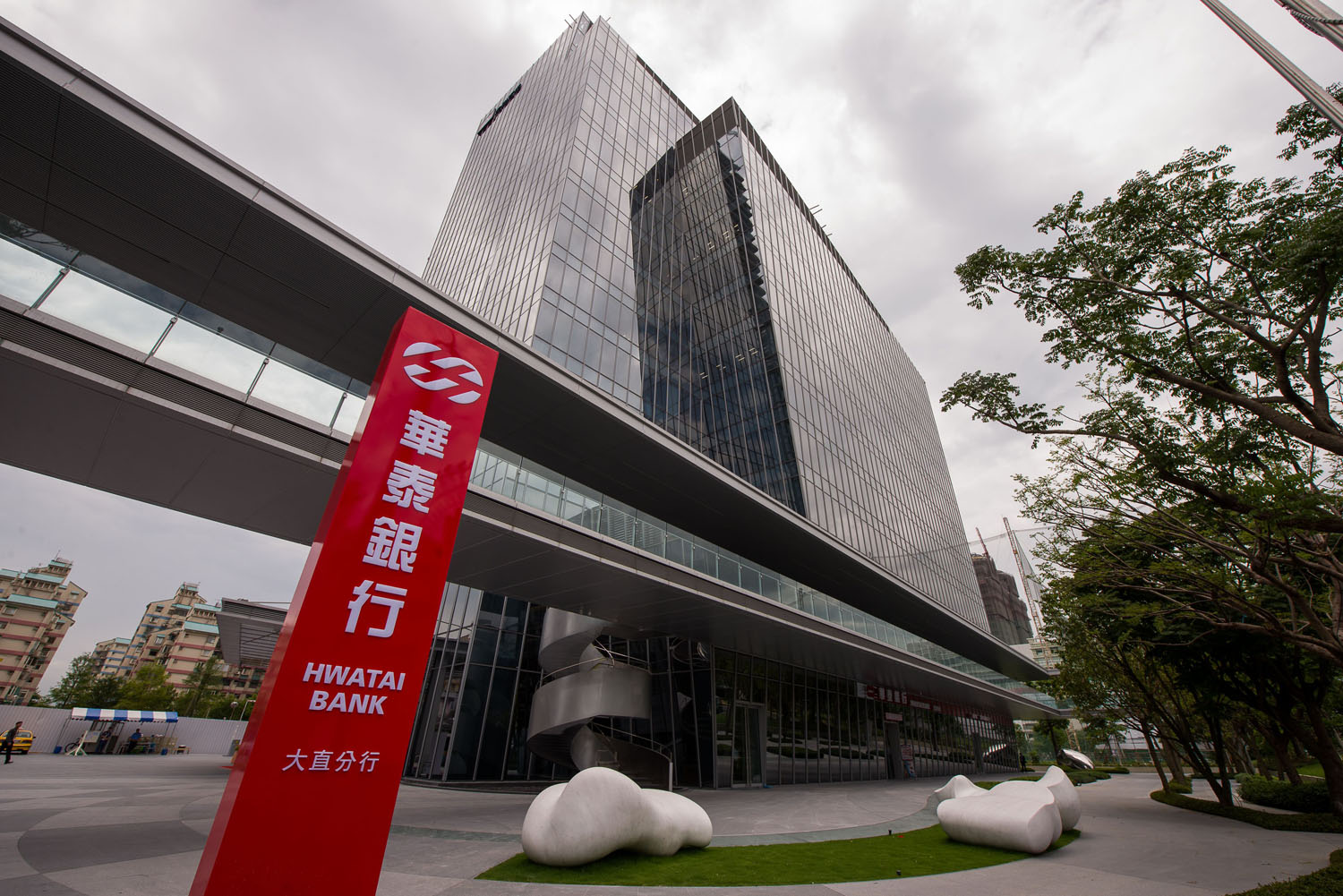

Dong Hu branch move to 1F, No.33, Jingye 4th Rd., Zhongshan District, Taipei, Taiwan, and renamed as Da Zhi branch.

The bank’s head quarter and the subsidiary (the Hwatai bank Insurance Brokers Co.) have been moved to 10-12F, No.33, Jingye 4th Rd., Zhongshan District, Taipei, Taiwan.

- 2014

A Special Award for outstanding performance in the extension of loans to SMEs was received from the Financial Supervisory Commission.

In the 2014 survey of bank customer satisfaction by Excellence magazine, Hwatai Bank received “Best Customer Service Bank” and “Best Wealth Management Bank” awards.

The Bank established an Audit Committee.

The Bank was honored with a “Golden Peak Award for Top 10 Outstanding Enterprises.”

Tainan Branch established.Passed SGS quality certification (Qualicert) with zero defects. The Nan Men Mini-Branch was relocated and renamed as the Taoyuan Branch.

- 2015

Compliance Department established.

The Bank was recognized by the Financial Supervisory.

Commission for its work on anti-money laundering and countering terrorism financing task force planning and implementation.

Northern Kaohsiung Branch established.

The Bank was presented one of the “12th Golden Torch Awards for the Top 10 Enterprises of the Year”

The Bank donated 10,000 cans of liquid nutriment to help victims of the dust explosion at the Formosa Fun Coast theme park.

A capital increase through capitalization of earnings brings the Bank’s total capitalization to NT$7,081,454,470.

Issued NT$660 million worth of subordinated financial bonds.

Issued NT$340 million worth of subordinated financial bonds.

- 2016

Changhua Branch established.

Northern Taichung Branch established.

“Special Award for SME Loans to Balance Regional Development” received from the Financial Supervisory Commission.

“Gold Award for Consumer Satisfaction” from the ROC Consumers’ Association.

Presented 2016 “Best Social Responsibility Award” from Excellence magazine.

North Taichung Branch established.

- 2017

Wen Shan Minibranch upgraded to Wenhsan Branch.

The Da Zhi Branch was renamed as the Main Branch

Chairman Po-yi Lin resigned and was replaced by Lai Chaohsien.

Acting President Hung-Jen Huang takes over officially as President.

Chen Hung-Jeng took office as president, replacing Huang Hung-jen, and the matter was reported to the competent authority for approval.

The raising of funds for a cash capital increase of NT$1.2 billion was completed; following this increase, the Bank’s capital stands at NT$9,387,676,280.

The Bank received a Best Public Care award from the Star of Finance awards jointly organized by the Taiwan Management Center of the Registered Financial Planners Institute (RFPI) of the U.S. and the Taiwan Registered Financial Planners Association (TRFP).

- 2019

Capitalization of earnings and capital surplus brought the Bank’s capitalization to NT$9,500,328,390.

The Bank was recognized with a Most Innovative Digital Funds Flow Service Award from the Financial Information Service Co.